Some doctors thrive in a personality-based clinic and have a loyal following no matter what services or equipment they offer, but for most chiropractic offices who are trying to grow and expand, new equipment purchases help us stay relevant and continue to service our client base in the best, most up-to-date manner possible. So, regarding equipment purchasing: should you lease, get a bank loan, or pay cash?

Student Loans: An Analysis of the Federal Register and Chiropractic Viewpoints, Part I

Editor's Note: This is a three-part series. Part II of Dr. Mirtz's article will appear in the July 3, 1995 issue of "DC"; Part III in the July 31 issue.

"We must either find a way or make one." -- Hannibal

This paper is an analysis of the Federal Register that was printed in response to the Department of Health and Human Services (HHS) concern for the default rate. This list of defaulters is in response to the rising rate of default as it relates to Health Education Assistance Loans (HEAL). Although the original document was released by the government on October 30, 1993, it still provides valuable information to the profession. The interpretation that is provided by this 226 page document can only serve the profession to take notice of the enormity of this problem.

The text of the October 30, 1993 Federal Register states that this issue is the first annual publication of the HEAL borrowers in default.1 How the HHS department was able to obtain and publish lists of defaulters was through an amendment within the Public Health Service Act (PHS). The PHS "previously amended its routine uses of the 'Privacy Act System of Records.'"1

The language of the Federal Register states who were excluded from the list:

- Those who have paid their loans in full subsequent to their default.

- Those who received HEAL cancellations due to death or permanent and total disability.

- Those whose loans have been repurchased from the department by a HEAL school, lender, or holder.

- Those who have been approved by the department for deferment or forbearance.

- Those who have made 12 monthly payments or the equivalent during the 12 month period prior to March 31, 1993.1

The analysis of the statistics and the figures that will be discussed on the charts and graphs shows more of a problem than was first reported. These figures are a comparison by state, school, and profession. It was decided that much debate between medical, osteopathy, and chiropractic exists at this moment that a comparison be made between these three schools of thought. It must be emphasized that the information and issues that are presented are by no means meant to embarrass any individual or group, but to present concern and ideas for future thought and discussion.

The Results

The analysis of the results of a review of the document reveals some interesting statistics. These statistics will reveal to the reader the economic situation that chiropractors face in comparison to other health care providers.

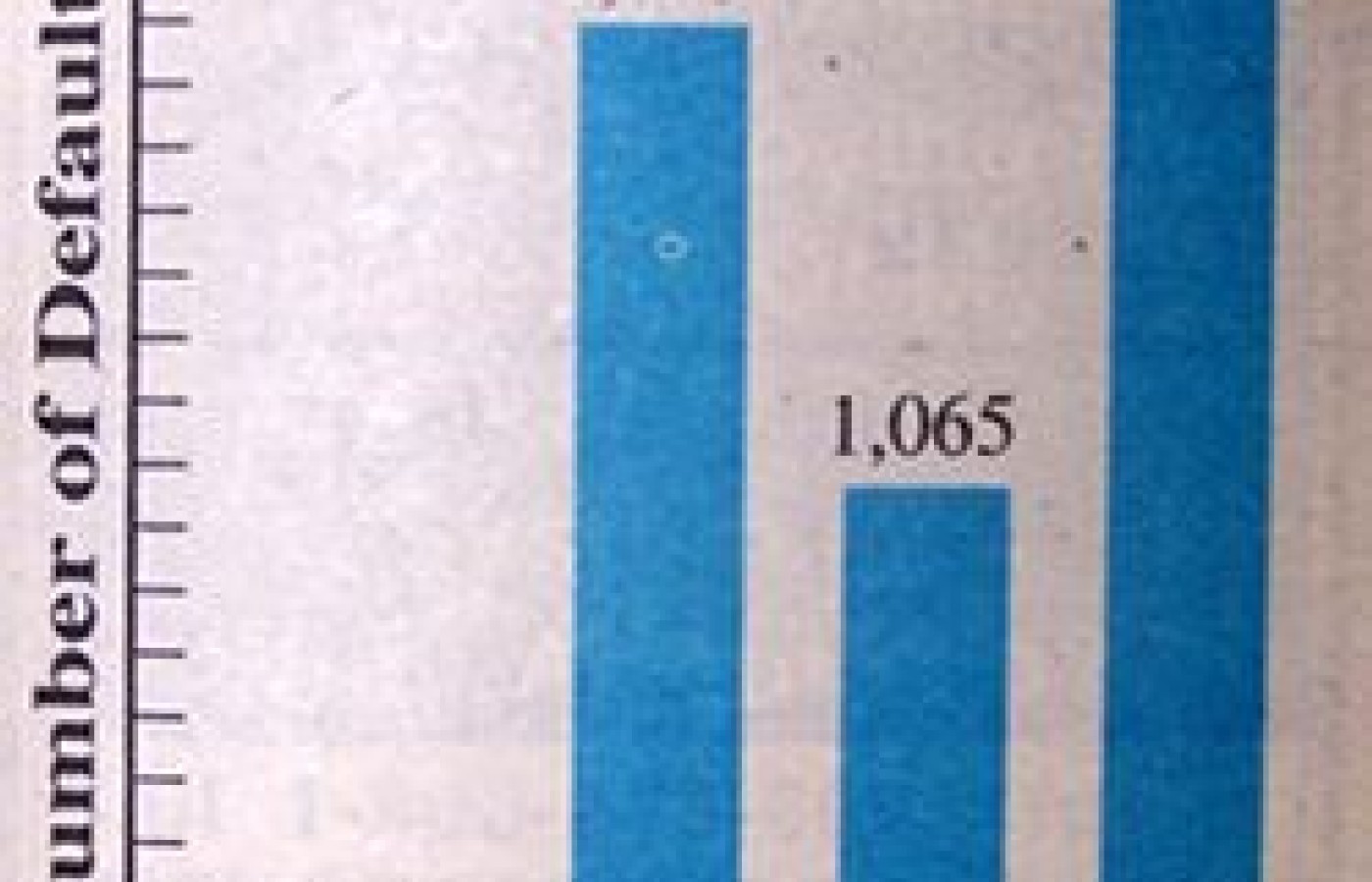

There were 4,973 HEAL defaults reported by the HHS. These HEAL recipients defaulted on a total of $228 million in federally funded loans. The chiropractic profession (Graph I) revealed that 1853 individuals or 37.2 percent defaulted. The chiropractic profession represented the highest group of defaulters of those professions eligible for HEAL funding. The 37.5 percent or 1869 of the "other" professions include veterinarians, podiatrists, dentists, psychologists, optometrists, pharmacists, public health and health administration students. Allopaths or medical doctors represented 21.4 percent or 1,065 individuals as well as 186 osteopaths or 3.7 percent defaulted on their HEAL obligations.

- DVM, DDS, DP, psychologist, optometrist, pharmacist, public health/health administration students.

HEAL defaults total $228 million in lost revenue to the federal government. Graph II represents that chiropractic comprised $78.9 million or 34.6 percent of the total. "Other" professions equaled $92.2 million or 40.4 percent of the HEAL total. Medicine's contribution to the $228 million comprised $44.9 million or 19.7 percent of the lost amount. Osteopaths in comparison represented only 5.3 percent or $12 million defaulted.

- DVM, DDS, DP, psychologist, optometrist, pharmacist, public health, health administration students.

Table I is a comparison of the total defaults of the profession-wide body of allopaths, osteopaths, and chiropractors. Although the figures from the two graphs show a large default disparity between medical doctors and chiropractors, Table I shows the number of practitioners in three schools of thought. This is a statistic of defaults within each profession.

This figure, although not large for the general population of chiropractic, is still out of proportion: 7.3 times larger than osteopaths; 23 times larger than the medical profession.

Table I

| Total Defaults | # in Practice | % of Profession | |

| DC | 1853 | 50,000(A) | 3.71 |

| DO | 186 | 36,500(B) | 0.51 |

| MD | 1065 | 670,000(C) | 0.16 |

| A- Today's Chiropractic | |||

| B- AOA 1994 | |||

| C- AMA 1993 | |||

Another interesting fact that came out of the analysis shows the cost per individual practicing chiropractor in comparison to the DOs and MDs if the cost was spread out among each of us to help carry the financial burden of our colleagues to erase this federal debt. That dollar amount is shown on Table II. The chiropractic debt is 23.5 times higher than allopaths; 4.7 times higher than DOs.

Table II

| Cost per Practitioner | |

| DC | $1,578 |

| DO | $333 |

| MD | $67 |

Tables III, IV, and V show the top 15 states and the number of defaults for the three major professions.

Table III

| Top 15 States for Chiropractic Defaults | |

| State | # of Defaults |

| 1. California | 396 |

| 2. Georgia | 191 |

| 3. Texas | 145 |

| 4. Florida | 141 |

| 5. New York | 80 |

| 6. Missouri | 71 |

| 7. Illinois | 65 |

| 8. Oregon | 62 |

| 9. Arizona | 61 |

| 10. Michigan | 55 |

| 11. New Jersey | 52 |

| 12. Iowa | 40 |

| 13. Colorado | 40 |

| 14. Minnesota | 38 |

| 15. Pennsylvania | 35 |

Table IV

| Top 15 States for Medical Defaults | |

| State | # of Defaults |

| 1. California | 166 |

| 2. New York | 101 |

| 3. Texas | 79 |

| 4. Illinois | 66 |

| 5. Maryland | 52 |

| 6. Florida | 43 |

| 7. Georgia | 42 |

| 8. Michigan | 42 |

| 9. Ohio | 42 |

| 10. New Jersey | 39 |

| 11. Pennsylvania | 38 |

| 12. Tennessee | 30 |

| 13. Massachusetts | 29 |

| 14. Louisiana | 27 |

| 15. Wash. D.C. | 25 |

Table V

| Top 15 States for Osteopath Defaults | |

| State | # of Defaults |

| 1. Michigan | 20 |

| 2. California | 16 |

| 3. Texas | 16 |

| 4. Florida | 14 |

| 5. Oklahoma | 12 |

| 6. Missouri | 11 |

| 7. New York | 10 |

| 8. Pennsylvania | 10 |

| 9. Ohio | 5 |

| 10. Iowa | 5 |

| 11. Illinois | 5 |

| 12. Massachusetts | 5 |

| 13. Louisiana | 4 |

| 14. Arizona | 4 |

| 15. Alabama | 4 |

Tables VI and VII indicate by chiropractic school in order of highest to lowest the number of defaults and the dollars defaulted by each school. Numbers have been rounded up to nearest $100,000.

Table VI

| Defaults by School | ||

| School | Rank | Defaults |

| Life | 2 | 457 |

| Palmer | 2 | 266 |

| Cleveland-KC | 3 | 183 |

| Texas | 4 | 134 |

| Los Angeles | 5 | 126 |

| Logan | 6 | 118 |

| Western States | 7 | 86 |

| Life-West | 8 | 81 |

| Cleveland-LA | 9 | 71 |

| New York | 9 | 71 |

| Palmer West | 11 | 69 |

| Northwestern | 12 | 61 |

| National | 13 | 57 |

| Southern Cal. | 14 | 40 |

| Parker | 15 | 31 |

| Pennsylvania | 16 | 2 |

Table VII

| Dollars Defaulted by School | ||

| School | Rank | Dollars in Defaults/Millions |

| Life | 1 | $23.40 |

| Cleveland-KC | 2 | 9.3 |

| Palmer | 3 | 8.9 |

| Los Angeles | 4 | 5.9 |

| Texas | 5 | 5.9 |

| Logan | 6 | 4.3 |

| Western States | 7 | 3.5 |

| New York | 8 | 2.8 |

| Palmer West | 9 | 2.8 |

| Life West | 10 | 2.8 |

| Cleveland-LA | 11 | 2.5 |

| Southern Cal. | 12 | 1.9 |

| National | 13 | 1.9 |

| Northwestern | 14 | 1.5 |

| Parker | 15 | 1.4 |

| Pennsylvania | 16 | 0.1 |

$78.9 million | ||

Table VIII is the average cost for each default for the three major professions discussed as well as the "others."

Table VIII

| Average Profession/Cost of Default | |

| DC | $42,579 |

| DO | 64,516 |

| MD | 42,159 |

| Others* | 49,331 |

- DVM, DDS, DP, psychologist, optometrist, pharmacist, public health, public health students.

Discussion

These statistics, although open for interpretation by chiropractic pundits, reveal an important fact. Chiropractic, in comparison with our main rivals, has a major problem. In reviewing the Federal Register of chiropractic woes, the thought of Ross Perot comes to mind. He reminded us the federal deficit was a major problem for the country's total economic picture. The same is true of our profession for this, without a doubt, is the "federal deficit of chiropractic."

Issue One: What Are We to Believe?

Is the current state of thinking within the profession one for the concern for the default rate or one of denial?

In a memo that was circulated profession-wide, James Parker, president of Parker College of Chiropractic states:

"All chiropractic colleges fight "the default on

loans" problems and we are fortunate to be doing

very well. This could become a major problem in

chiropractic education if graduates don't succeed

and pay off loans."2

This has to be the first public statement by a chiropractic college president admitting that there is concern. This profession has been existing in denial of what is bound to explode in the next few years.3

Gerard Clum, president of Life-West Chiropractic College, eluded to the situation in 1992.

"Attention had been focused on the default rates. It remains the consensus with those most closely involved that the administration sought to characterize the numbers as unfavorable as possible and with a true apples-to-apples comparison that would have put the numbers in their proper perspective."4But what are we to believe? Especially those, with a huge debt ranging in the $65,000 to $85,000 range prior to licensure, which will be a majority of the practicing chiropractors. John Hofmann, a leader in the ICA, states on the current state of the profession:

"The profession is on the rise. Barriers have been broken, allowing us to take care of the vast majority of people of the world. No longer are we relegated to the 10% that we care for now. We have broken through."5Legislators and taxpayers only look at the problem. They don't focus nor care what caused it, they only see the end result. They look upon us as health care providers and with this responsibility comes fiscal responsibility as major health care providers.

The statistics that are shown in the graphs and tables are apples-to-apples comparisons. The numbers that are presented can only be shown as unfavorable: those are the facts. The HEAL system, is still the same loan that other health care providers received.

Because of this equal access to this loan, only those who make the rules governing the loan can only see an apples-to-apples comparison. But the discrepancies are not within the HEAL program entirely, but outside the program itself.

Sid Williams, president of Life College, compounds the problem with statements that give an impression of equality:

"We have nurtured it (chiropractic) to produce a huge, sturdy tree which now stands tall in the worlds system of health care."6But the two previous statements paint a picture of a profession with no economic problems. The following series of issues that are going to be discussed deal directly with the student loan default situation and the economics of chiropractic. These are controversial issues that are having an impact now and must be addressed.

Issue Two: The Chiropractic Profession's Response to this Growing Concern.

With the increasing default rate of the HEAL problem with chiropractic accounting for 37.2 percent of the rate, the profession risks a "time will tell" anxiety. This anxiety results from being eliminated from the program entirely. Gerard Clum, while serving as president of the Association of Chiropractic Colleges stated:

"The importance of the HEAL program to chiropractic education can't be overlooked and it would be disastrous to fail to appreciate its impact on chiropractic education."4The Department of HHS indicated that more than 50 percent of all chiropractic students participate in the HEAL program.7 The chiropractic profession now has the Chiro-loan. Chiropractic schools now are not giving HEAL default rates because of the change to this loan. But the reality is that a changing of name does not erase the past debt that has been accumulated. The potential that this new loan will decrease default rates is pure speculation. It is still generally accepted that 90 percent of all chiropractic students use student loans.8 The student population now ranges between 10,000 and 11,000 individuals.9

Let's look at what the Office of Management and Budget (OMB) had to say about chiropractic. The OMB made its recommendation about the HEAL program prior to President Bush's 1991-92 budget proposal.

- The HEAL loan should be abolished.

- Chiropractic was a non-essential service.

- The chiropractic profession had not proven themselves worthy of the public trust and consequently should not have their students funded.4

According to some within the profession the OMB position on chiropractic educational funding came as no surprise.

Gerard Clum then stated:

"It should be noted that the administrations primary concern was to send a strong message to the profession. It was a matter of what we already knew."4The question that needs to be answered is why hadn't the profession-at-large acted accordingly to a growing concern? If we already knew of a high default rate why wasn't action taken?

Then on October 30, 1993 came another embarrassment to chiropractic. The Department of HHS under the Clinton administration printed the names of all HEAL program defaulters. The media targeted local DCs who had defaulted on student loans with a "humiliate and locate" emphasis.8

The ACA did make a response after the Federal Register printing. The ACA cited the government, the HEAL program, and the health care system in general as causing discrimination against chiropractic.10

Jerome McAndrews, a leader of the ACA stated:

"The ACA is working diligently to remedy these injustices, help chiropractors who have defaulted get back on their feet."10But how does the ACA plan to help defaulters in chiropractic get back on their feet? The ACA listed what it felt were problems within the government. It also used the argument that taxpayer supported institutions that medicine and osteopathy enjoy, and chiropractic doesn't, was an injustice. But no specific plan, short-term or long-term, was given. No details of how the ACA would posture itself to combat the injustices. How does the ACA plan to help those 1,853 defaulters get back on their feet individually and collectively? But before any long or short-term plan can be made, an actual detailed study of what makes for a typical chiropractor to default must be done. To this date no study has been conducted. There are so many variables that must be included. The ACA mentioned only the ones that we generally assume to be for the profession-at-large without indicating any change in status. James Gregg, president of the ICA states:

"The problem of our founding generations have been resolved and have been replaced by a whole set of challenges."11Issue Three: The Role of the Federal Government

The current national political scene could pose some potential problems for the chiropractic profession.

The November 8, 1994 elections, which saw for the first time in 40 years a republican controlled House of Representatives, has been interpreted as a mandate by the citizens. The combination of a republican majority could have potential effects on chiropractic educational funding.

The republicans campaigned on the concepts of a) less taxes, b) less government, and c) individual responsibility. To understand these concepts a deeper interpretation of each of these and its possible effects toward chiropractic will be discussed.

The Concept of Less Taxes

Defaults cost taxpayers money. The Associated Press reported on 8-24-93 that in 1991 taxpayers lost $3.6 billion on bad student loans.12 The defaults that aren't paid can't go back to the treasury to service the program. If the student defaults, one of 47 guarantor agencies tries to collect. If they are unsuccessful then the government pays off the loan.12 This lost revenue goes toward the federal deficit. The Bush administration's budget as stated earlier wanted to eliminate chiropractic from its funding. The Federal Register as seen on Graph II shows that the chiropractors cost taxpayers $78.9 million.

Senator Robert Dole (R-KS) in an interview said, "All programs will be examined from A to Z for efficiency. There are no sacred cows."13

The Concept of Less Government

Since the default rate was so high and cost was enormous to taxpayers the prospects of the HEAL program may be eliminated. The republicans in the zeal to cut federal programs that are inefficient could use the 1991 OMB recommendation and abolish chiropractic funding. The thought of losing that funding, let alone even a threat to that funding base, could be devastating.4

The Concept of Individual Responsibility

The argument that could be used by the legislators, if they decide to go with the 1991 OMB recommendation, is to suggest: "If you want to be a chiropractor, great -- don't expect the federal government to finance you. It's your responsibility to find financing."

References

- Federal Register, October 30, 1993, Department of Health and Human Resources.

- Parker J. Parker College of Chiropractic, Letter, June 10, 1994.

- Author unknown. A cry for help, Letter, The Chiropractic Journal, Volume 6, #3, December, 1991.

- Clum G. The HEAL saga, Dynamic Chiropractic, Volume 10, #2, January 17, 1992.

- Hofmann J. A view from the field: Reflections, Dynamic Chiropractic, Volume 12, #26, December 16, 1994.

- Williams S. 1995: A time to adjust ourselves to what is best for chiropractic. Today's Chiropractic, Vol. 24, #1, Jan/Feb 1995.

- HEAL problems: The never ending story: Special Report, American Chiropractic Association, ACA/FYI Feb 1992 p15.

- Mirtz T. Student loans: am economic crisis, Dynamic Chiropractic, Vol. 12, #15, July 15, 1994.

- Chiropractic facts and figures, Today's Chiropractic Vol 24, #9, Jan/Feb 1995, p26.

- McAndrews, J. HEAL update: ACA says correction of inequities will allow DCs to pay up. Special Report, American Chiropractic Association, ACA/FYI, Sept/Oct 1993, p11.

- Gregg J. Chiropractic: A timeless science, Today's Chiropractic Vol. 24, #1, Jan/Feb 1995, p68-72.

- Schools facing dismissal from loan programs, Associated Press, August 24, 1993.

- CNN: Inside Edition: interview with Bob Dole, Jan 9, 1995.

Timothy Mirtz BA, DC

935 Iowa Street, Suite 2

Lawrence, KS 66049