It’s a new year and many chiropractors are evaluating what will enhance their respective practices, particularly as it relates to their bottom line. One of the most common questions I get is: “Do I need to be credentialed to bill insurance, and what are the best plans to join?” It’s a loaded question – but one every DC ponders. Whether you're already in-network or pondering whether to join, here's what you need to know.

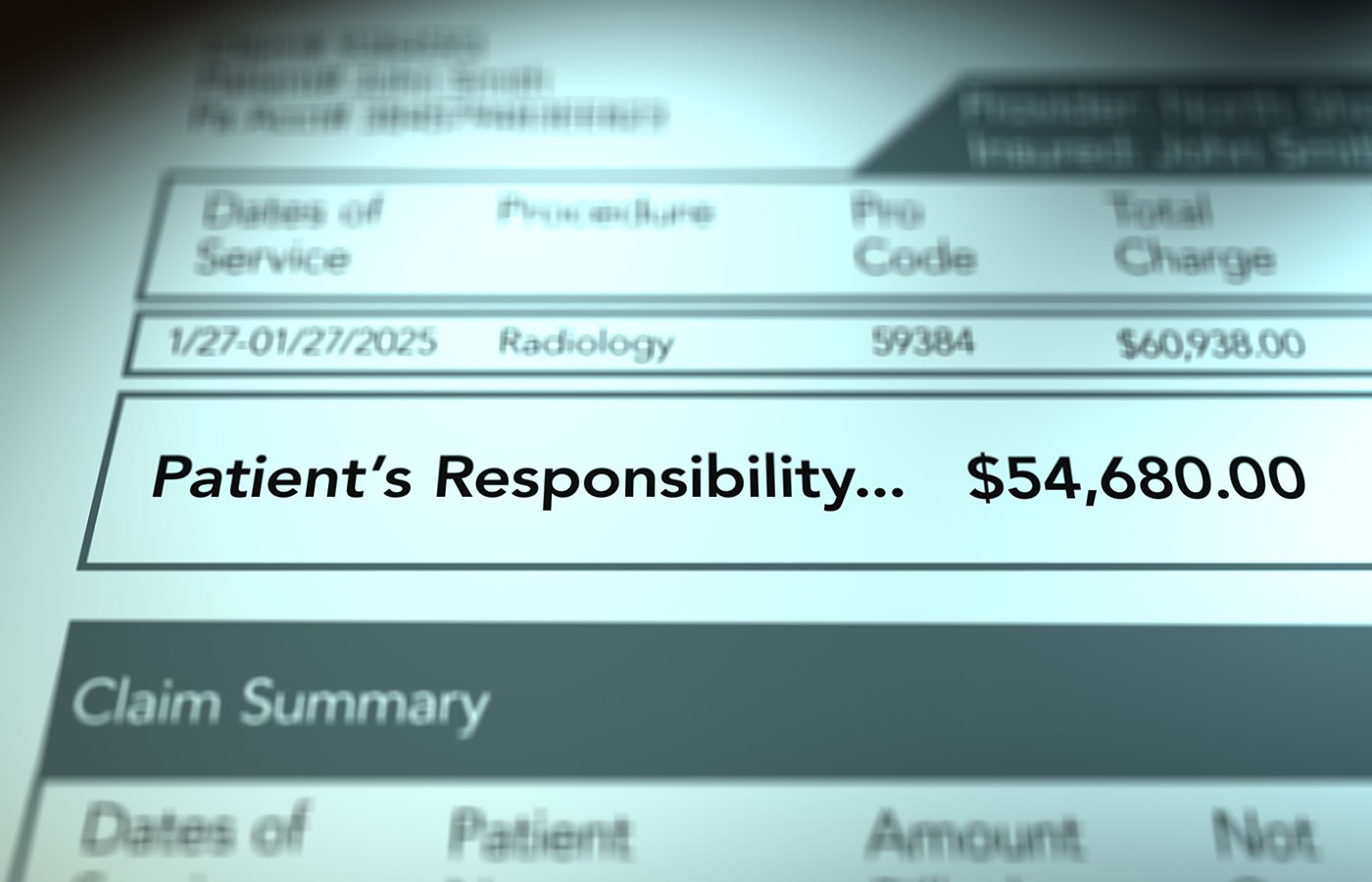

Medical Debt Collection Limitation Laws: A Nationwide Trend?

- New Jersey's Medical Debt Relief Act prohibits healthcare providers and debt collectors hired by such providers from reporting any healthcare debt to a consumer reporting agency for healthcare services.

- California Governor Gavin Newsom signed a law that took effect July 1, 2025, which does effectively the same thing as in New Jersey for the most part.

- Please be aware that a similar law may be coming to your state. The time to act is before the law is passed.

Editor’s Note: This column is authored by members of the National Association of Chiropractic Attorneys (NACA: [url=https://nacaattorneys.com/]https://nacaattorneys.com/[/url]), featuring legal updates as they relate to DCs.

On July 22, 2024, New Jersey Governor Phil Murphy signed the Medical Debt Relief Act into law. Effective as of the date of signing, the law prohibits healthcare providers (including chiropractic physicians) and debt collectors hired by such providers from reporting any healthcare debt to a consumer reporting agency for healthcare services performed on or after the effective date. This sweeping law includes virtually all healthcare providers.

Healthcare providers covered by the law are prohibited from charging interest on unpaid debt of more than 3% per year, and cannot initiate collection actions until after 120 days from when the bill was sent to the patient and the patient has been offered a “reasonable payment plan” as defined by the statute.

In New Jersey, doctors are also now prohibited from garnishing the wages of patients after obtaining a judgment for unpaid healthcare debt of any patient who makes less than 600% of the federal poverty level. The law further provides that any communications, whether paper or electronic, to collect a healthcare debt must include a statement that neither the healthcare provider nor their collection agent has reported the debt to a consumer reporting agency, and that any debt reported is void.

On the opposite coast in California, Governor Gavin Newsom signed a law that took effect July 1, 2025, which does effectively the same thing as in New Jersey for the most part. This doesn’t mean a provider can’t collect unpaid bills via other legal avenues; only that the debt may no longer be reported as part of a patient’s credit rating. And like in New Jersey, violating these provisions can extinguish the debt.

However, California went even further. In California, all contracts or patient financial agreements signed on or after July 1, 2025 must (not may) include the following exact statement to remain enforceable:

“A holder of this medical debt contract is prohibited by Section 1785.27 of the Civil Code from furnishing any information related to this debt to a consumer credit reporting agency.”

If a medical office fails to have this statement included in their financial agreements (and read broadly, that would include personal-injury liens), “the debt shall be void and unenforceable.”

These laws represent a disturbing trend that will negatively impact a practice’s ability to collect monies from patients, as well as expose them to significant penalties if the practice does not follow the mandatory guidelines to a T.

For example, in New Jersey under the act, any portion of a medical debt that is reported to a consumer reporting agency in violation of the act is automatically void. Further, engaging in a pattern of violating the act is considered an unlawful practice under the New Jersey Consumer Fraud Act, subjecting the practice to penalties of up to $10,000 for the first offense and $20,000 for each subsequent offense.

And in California, they went so far as to say a violation of these provisions is a licensing violation. So, your license to practice your profession is also at risk for noncompliance with this new law.

In addition to the above penalties, these statues also have serious implications for revenue cycles and the financial sustainability for independent medical practices in states in which they exist. Please be aware that a similar law may be coming to your state. The time to act is before the law is passed. See if legislators will listen to reason and moderate the harsh provisions that exist in New Jersey and California, and instead facilitate in a more doctor-friendly law.

Editor’s Note: For more information on medical debt, click here.